Unlocking Profits: A Comprehensive Guide to Forex Copy Trading

In the world of financial markets, finding a strategy that balances risk and reward can be challenging. Forex copy trading is one such strategy that has gained significant traction in recent years. By allowing traders to copy the trades of more experienced professionals, it provides an accessible entry point for novice traders while offering seasoned investors the opportunity to expand their portfolio. At forex copy trading World Forex Brokers, we delve into the intricacies of this approach and how it can transform your trading experience.

What is Forex Copy Trading?

Forex copy trading refers to a method where an individual (the follower) can replicate the trades of a more experienced trader (the signal provider). This mutual arrangement allows less experienced traders to benefit from the expertise of seasoned professionals without needing to master in-depth trading strategies themselves. The flexibility of copy trading caters to both full-time and part-time traders who may not have the time to conduct extensive market analysis.

How Does Forex Copy Trading Work?

The concept of copy trading is relatively straightforward. Once a trader selects a signal provider—often based on their performance metrics, trading style, and risk appetite—they can choose to allocate a portion of their capital to mirror the provider’s trades in real-time. Here’s a step-by-step breakdown of how the process works:

- Choose a Trading Platform: Selecting a reliable Forex broker that offers a copy trading service is the first step. Many platforms have integrated tools specifically for copy trading.

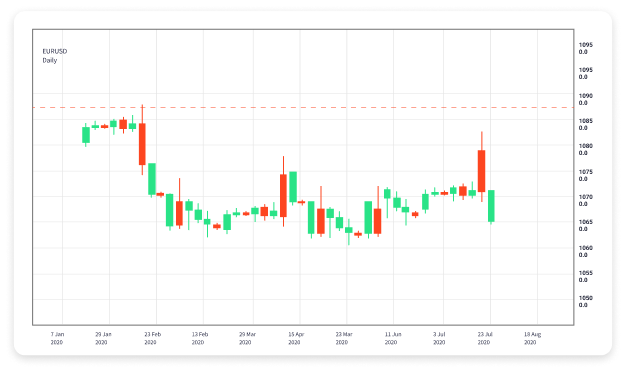

- Select a Trader: Look at the performance-analytics of signal providers. You can consider aspects such as historical returns, risk levels, and trading frequency.

- Allocate Funds: Once you pick a provider, you’ll designate how much of your capital you want to copy their trades with.

- Monitor Performance: After setting up your copy trading account, it’s important to monitor the trades closely. While the trades are executed automatically, understanding overall performance is crucial.

Benefits of Forex Copy Trading

Forex copy trading has several advantages that make it appealing to a wide range of investors:

- Easy to Start: With minimal knowledge of Forex trading, anyone can enter the market and begin copying trades.

- Diverse Strategies: Each signal provider has a unique trading approach. This diversity allows traders to find strategies that resonate with their personal risk profiles.

- Time-Saving: Copy trading eliminates the need for extensive market analysis, making it convenient for busy individuals.

- Potential for Profit: By replicating successful traders, followers have the potential to earn profits without being experts themselves.

Risks Involved in Forex Copy Trading

While copy trading offers numerous benefits, it’s not without risks. Understanding these risks is essential to successful trading:

- Dependence on Providers: The success of your trades relies heavily on the performance of the provider you choose. If they experience losses, you will too.

- Lack of Control: Copying trades means you forfeit some control over your trades and investment strategy.

- Market Volatility: Forex markets can be unpredictable. No trader is immune to losses, even the top professionals.

- Over-diversification: Copying too many traders can lead to diluted performance and increased risk.

Finding the Right Forex Copy Trading Provider

Choosing a trading provider is arguably the most critical aspect of Forex copy trading. Here are some tips to guide your selection:

- Performance Track Record: Look for transparency in the provider’s trading history, including profit and loss ratios.

- Risk Management: Assess how the provider manages risk. A good trader won’t just chase profits but will prioritize risk mitigation.

- Trading Style: Ensure that the provider’s trading style aligns with your risk tolerance and investment goals.

- Interaction: Some platforms allow communication between providers and followers, which can be beneficial for learning purposes.

Setting Up Your Forex Copy Trading Account

Once you’ve chosen your provider, the next stage is setting up your copy trading account. Here’s what you need to do:

- Register with Your Chosen Broker: Complete the registration process on the trading platform.

- Fund Your Account: Deposit money into your trading account. Ensure that you are comfortable with the amount you’re using for copy trading.

- Link to Your Signal Provider: Select your chosen provider and allocate the capital you want to use for copying their trades.

- Configure Settings: Many platforms allow you to set risk management parameters, such as maximum drawdown limits.

Conclusion

Forex copy trading can be a powerful tool in a trader’s arsenal, especially for newcomers seeking to navigate the complex world of Forex with more assurance. By leveraging the experience of established traders, less experienced individuals can cultivate their trading strategies and potentially increase their profitability. However, as with any investment strategy, careful consideration of the risks involved is vital. Always ensure that you are adequately informed before diving into the realm of copy trading, and remember that diversification and diligence can go a long way in securing your trading future.